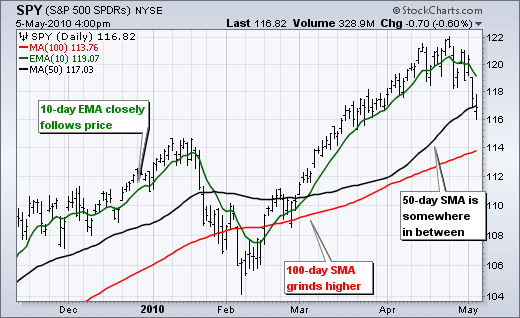

Lookback periods for calculating the moving average indicator The red line (10 day moving average) is closest to the blue line (price curve) and the purple line (50 day moving average) is farthest away. As the lookback period increases, the moving average line moves away from the price curve. It can be observed that the 50 day moving average is the smoothest and the 10 day moving average has the maximum number of peaks and troughs or fluctuations. The chart above shows the closing price of a futures contract (blue line), the 10 day moving average (red line), the 20 day moving average (green line) and the 50 day moving average (purple line). Let us now see the example of moving average trading with a chart showing 10 day, 20 day and 50 day moving average.

50 EMA VS 200 EMA SERIES

A moving average series can be calculated for any time series. It can be seen that the subset for calculating averages moves forward by one data entry, consequently, the name moving average (also called running average or rolling average). The average is calculated for five data points. Let us see the example mentioned below which shows the calculation of simple moving averages. In financial markets, it is most often applied to stock and derivative prices, percentage returns, yields and trading volumes.Ĭalculation of a moving average indicator The price of securities tends to fluctuate rapidly, and as a result, the graphs contain several peaks and troughs making it difficult to understand the overall movement.īut with moving average trading, the moving averages help smoothen out the fluctuations, enabling analysts and traders to predict the trend or movement in the price of securities. The moving averages with shorter durations are known as fast moving averages and are faster to respond to a change in trend.įast moving averages are also called smaller moving averages since they are less reactive to daily price changes. The lagging indicators exist because they are computed by using historical data.Ī faster moving average (short term or short lookback period) has less lag when compared to a slower moving average (long term or long lookback period).

Moving averages are known to be lagging indicators as they lag behind movements in the price/volume charts. Depending on the trader’s preference, the lookback periods can be in minutes, hours etc. Moving averages work on the basis of durations (also known as lookback periods) such as 10 day, 20 day and so on. In other words, as we get newer data, the first element of the subset is excluded and the most recent element is added, this keeps the length fixed. The subset is then modified by shifting it forward by one value. Given a series of numbers and a fixed subset size, the first element of the moving average series is obtained by taking the average of the initial fixed subset of the number series.

0 kommentar(er)

0 kommentar(er)